The case for hardware subscriptions

HaaS makes for a more intentional and sustainable relationship between the consumer and the device.

I’ve recently been thinking about how the value of certain products is best conveyed by getting it in the hands of customers. This is especially true of products that create a truly novel experience, where it’s best to let the product itself do the talking — think Peloton, Slack, or Zoom.

With software, it’s fairly easy to distribute to potential customers with a free trial because there’s no cost to letting more people try out the product. With hardware, on the other hand, it’s more tricky — there are shipping costs involved and you can’t simply repackage returned hardware as new anymore.

As a result, hardware companies can’t afford to offer a true free trial experience. There is usually a customer satisfaction period within which you could return the product, but the consumer still has to pay the upfront sticker price to get their hands on it.

What if these companies adopt a Hardware-as-a-Service (HaaS) model, where customers pay for the value provided by the service, rather than the underlying hardware? This is analogous to the ubiquitous Software-as-a-Service (SaaS) model, where software is licensed on a subscription basis rather than a one-time purchase.

The HaaS model gives consumers the ability to essentially rent or lease the hardware product rather than owning it. This translates to a lower upfront cost as well as the ability to pause or terminate the subscription if you aren’t using it.

Importantly, it also makes consumers more open-minded about trying products from less established brands by reducing the barriers to experimenting with different devices, which is valuable in the post-pandemic world where the in-person store experience is much less common.

Consumer hardware startups building expensive, software-enabled devices will see a lot of upside from adopting a HaaS pricing model.

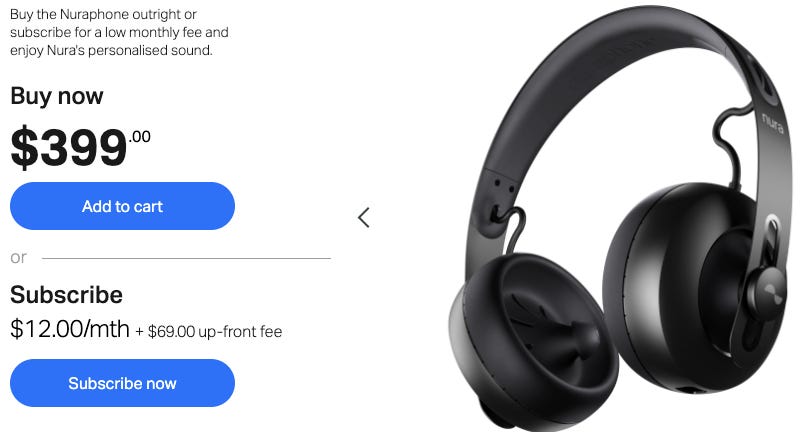

Let’s take a look at a case study: the NuraNow subscription program.

For context, Nura developed tech to analyze the acoustic dynamics of your ears and personalize the perfect sound. Until Apple released the AirMax Pro’s (at $550!), the Nuraphone was one of the most expensive headphones on the market at $400.

If you’re like me, this sounds pretty cool but I wouldn’t go so far as to outright buy it. Luckily, they have another plan where you pay only $70 up-front and then $12/month for as long as you own the nuraphone. You can cancel anytime and every 24 months, you have the option to upgrade. Importantly, you never really own the Nuraphones — if you stop paying, the device will be deactivated and you have to send it back.

This might seem counterintuitive. Why not just let people buy out their device similarly to how you could buy out a car after leasing it for a couple of years?

The assumption is that the consumer wants to own the hardware rather than the underlying service (high quality, personalized music delivery). This may seem like semantics, but there’s an important distinction here — owning a device means that you are liable for any damages or repair costs once the warranty is up. Additionally, if a new device comes out with a killer feature in a couple of years, you will have to pay the up-front cost again.

Now, this might not matter in the saturated smartphone market where, year after year, there isn’t much of a difference between models. But when it comes to emerging technology — like a VR headset, AR glasses, or an EEG headset — you probably want to upgrade often because the experience will change dramatically with every model.

Not only that, but HaaS makes for a more intentional and sustainable relationship between the consumer and the device.

Think about all the devices you have collecting dust in some drawer — I am certainly guilty of this with an iPad I bought back in March. If you’re getting consistent value out of it, then it should be worth the monthly cost. If not, just return it so that someone else can make use of it.

From the consumer perspective, you save on the difference between the amount paid so far in subscription costs and the full up-front cost of buying the device. In fact, the only time you don’t save money is when you’ve used the device for 2 - 3 years already, at which point it’s a good investment anyway since you seemingly got so much value of it.

From the hardware startup’s perspective, this is a net positive if you only have capacity to manufacture in small batch sizes and need the extra inventory. That being said, if you’re building a novel experience that people get continuous value from, then you don’t have to worry about a high churn rate.

The HaaS model also lets companies effectively build loyalty and longer customer relationships, as long as they’re consistently adding value over time — whether through new models, software updates, or both. The subscription is even more compelling when the software is a significant part of the product offering and updates can really improve the customer experience (think Tesla’s autonomous driving software upgrades).

For other examples of HaaS in action, check out Neosensory (early termination fee) and Peloton (up-front cost + subscription).

For brevity’s sake, I won’t cover the risks, costs, and pain points associated with the HaaS model but I’m hoping to do so when I turn this into a full blog post. Stay tuned!

Friday Brainstorm Newsletter

For more, join 300+ curious people subscribed to the Friday Brainstorm newsletter. It’s one email a month with the most interesting ideas I've found related to science and health.